Web3 in Japan: Latest 2025 Data, Market Size, and Insights

Japanese Web3 Market

Japan, a highly developed nation in Asia with a population of 124 million, is experiencing a steady decline in its youth demographic. Despite vibrant sectors like equities, real estate, anime, and tourism, public attention is fragmented, resulting in less motivation among younger people to engage with crypto; the majority of crypto participants are therefore middle-aged adults.

Nevertheless, driven by global exposure and the rising popularity of cryptocurrency, crypto participation in Japan is accelerating. By May 2025, both the number of users and total trading volume reached record highs.

Key traits: 12.41 million total users, dominated by middle-class individuals in their 30s and 40s. These are primarily wealth-oriented, long-term investors rather than pure speculators. Most have annual incomes below 7 million yen (approximately 320,000 RMB). Due to the high tax rates on crypto gains in Japan, most users are holding rather than selling—waiting for the 2026 tax reduction policy.

Market Size and Growth of Crypto in Japan

In 2022, total spot trading volume across all licensed Japanese exchanges stood at just 1 trillion yen (about $6.8 billion). By 2023, this climbed to 1.13 trillion yen ($7.6 billion), a modest 13% annual increase.

However, in 2024, following Wall Street’s widespread embrace of Bitcoin, total domestic spot trading surged to 2.06 trillion yen ($14 billion), an 82% year-over-year jump. This marked Japan’s emergence as a market of true scale.

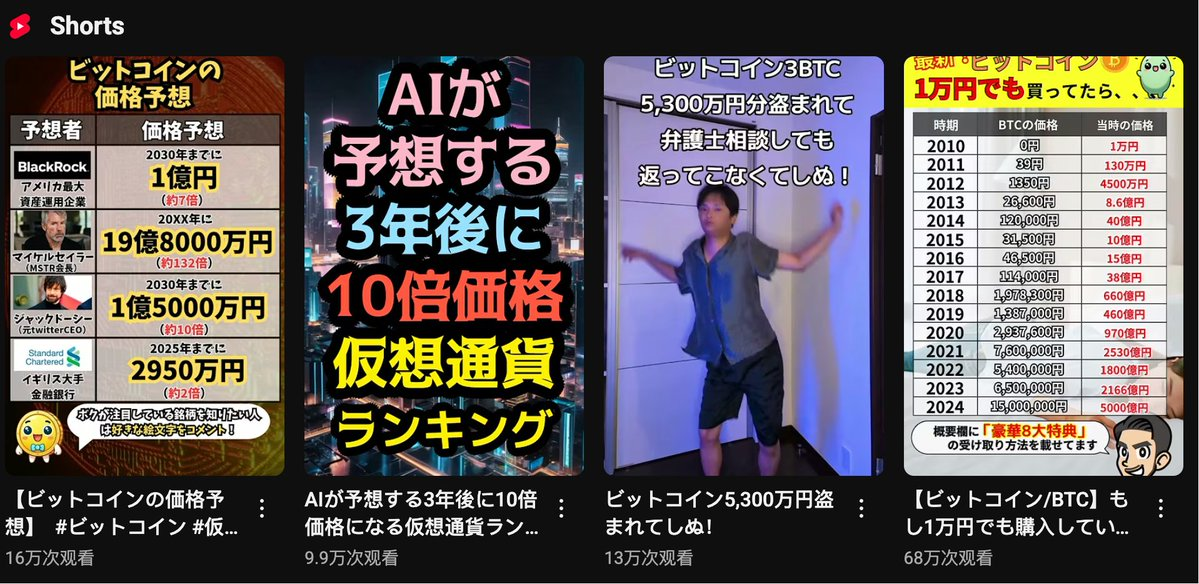

In trading, Bitcoin (BTC) accounts for about 70% of volume, while Ethereum (ETH) represents just 14%. As a result, many regulated Japanese exchanges focus their marketing on BTC. For example, exchange advertisements for Bitcoin frequently appear on TikTok.

Additionally, starting in 2024, XRP’s popularity even slightly edged out ETH.

12.41 million users in the crypto market

This figure might look strong—at least 12.41 million crypto users—but in reality, user growth only began accelerating in 2024.

In 2022, crypto users in Japan numbered just 5.61 million. By 2023, that rose to 6.46 million, a 15% increase. By 2024, the number shot up to 9.17 million, marking a 41% increase.

As of May 2025, the tally reached 12.419 million. Japan’s crypto market is clearly seeing rapid expansion among domestic users, with assets under custody surpassing 4.26 trillion yen (roughly $27.5 billion).

Investor Demographics

As of May 2025, Japan has 12.41 million crypto users, accounting for roughly 15% of the country’s adult population.

The core investor group is middle-class individuals aged 30–40, characterized by:

- Heavy reliance on Youtube, X, and other social media platforms

- Stable household income

- Annual income under 7 million yen

Investment behavior and motivation:

- Wealth management and long-term portfolio allocation—not speculative trading

- Mostly small-scale participation via exchange apps

- Low trading frequency, with most placing just a few orders a year

- Very few on-chain native participants

Overall, Japan’s crypto user base is rapidly mainstreaming, with a strong preference for safety and simplicity.

This trend has led most Japanese project teams and exchanges to prioritize long-term partnerships with influencers on Youtube and X over traditional media advertising. As a result, Japan’s crypto scene is now an ecosystem where almost everyone aspires to become an influencer, further pressuring conventional media outlets.

Regulatory Environment

Japan’s approach to crypto regulation closely mirrors that of the United States, based on a three-layer system coordinated by the FSA (Financial Services Agency), JVCEA (Japan Virtual and Crypto Assets Exchange Association), and JCBA (Japan Cryptoasset Business Association).

As a result, most crypto companies operating in Japan are members of both JVCEA and JCBA. For instance, Binance Japan has disclosed on Twitter that it is a JVCEA member.

Any exchange or custodian seeking to legally operate in Japan must obtain the appropriate licenses and memberships. In recent years, asset managers and exchanges entering Japan have often used shell company acquisitions or similar structures for local market access.

Policy on Non-Compliant Offshore Exchanges

In addition to domestic compliant exchanges, many non-compliant offshore platforms have previously promoted and operated in Japan, capturing significant user bases. Primary reasons for using offshore exchanges include:

- Tax avoidance or evasion

- Broader crypto asset selection

- Full range of leverage and derivatives

As of February 2025, these platforms have been jointly targeted by the FSA and the Japanese government. They have been delisted from the Japanese Apple Store and Google Play Store, and some Japanese influencers who promoted them have received legal notices.

However, since Japan does not restrict web access, users can still visit and use these non-compliant offshore platforms. A portion of users continue trading there, but local promotion has become notably more discreet.

Crypto Tax Controversy

Surveys by local agencies indicate that the most common pain points for crypto users are tax burdens and reporting complexity. These issues are especially acute because most Japanese retail investors treat crypto as a form of wealth management (holding for the long term), and comprehensive taxation plus complex accounting raise the barriers to entry.

It’s widely known that if you buy 30 million yen in BTC on a compliant local exchange and make a profit, you face a 45% miscellaneous income tax plus 10% resident tax the following year—an effective tax rate of about 55%.

The Financial Services Agency has now determined that crypto taxation will be revised in 2026, aligning it with the rate for stocks at approximately 20%.

Therefore, investors will only need to pay a maximum of 15.315% national tax plus 5% local resident tax, with no further liability after payment. Corporate investors pay only the 15.315% national tax, exempt from local government taxes.

This tax regime is expected to launch in 2026, coinciding with the introduction of Japan’s BTC and XRP spot ETFs.

How Project Teams Operate in Japan

One of the most frequently asked questions recently is how project teams actually operate in Japan, and what limitations they face.

Currently, at least 20 well-known project teams maintain offices or staff in Japan, but most are registered as R&D or operations entities rather than full-scale commercial ventures.

This is because any project team seeking to launch extensive market activity in Japan—such as issuing tokens to Japanese users or listing on a regulated Japanese exchange—must first pass JVCEA (Japan Virtual and Crypto Assets Exchange Association) review. Compared to Southeast Asia or Dubai, Japan’s compliance hurdle is higher and far costlier.

As a result, most project teams in Japan do not serve the Japanese market directly. They conduct token sales and operations via BVI or other offshore entities, while using Japanese companies only for staffing, R&D, and office-related expenses.

This is the prevailing approach for both Japanese native projects and foreign project teams with a presence in Japan.

Physically in Japan, but not targeting the Japanese market.

We hope you found this information helpful.

Disclaimer:

- This article is reproduced from [_FORAB]. Copyright belongs to the original author [_FORAB]. If you have any concerns about this reprint, please contact the Gate Learn team—we will respond promptly according to our procedures.

- Disclaimer: The views and opinions expressed in this article are those of the author alone and do not constitute investment advice.

- Versions in other languages are translated by the Gate Learn team. Do not copy, distribute, or plagiarize these translations unless credit is given to Gate as specified.

Related Articles

Solana Need L2s And Appchains?

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What Is Ethereum 2.0? Understanding The Merge